Extension of validity of pre shipment Inspection Agencies C: In case the goods are assessed provisionally, the details may be given separately in Table at serial number 3. Columns which are not applicable may be left blank. Imposition of penalty on Customs Broker - It was alleged against the a The columns not applicable may be kept blank. Where the duty is specific and is charged based on specified unit quantity, the same quantity code must be used for showing clearance figures.

| Uploader: | Muzragore |

| Date Added: | 1 May 2012 |

| File Size: | 22.85 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 26745 |

| Price: | Free* [*Free Regsitration Required] |

In column 6 of Table at serial number 3, the assessable value means, a. Details of the manufacture, clearance and duty payable. In the Tables at serial numbers 4 and 7, the BSR codes of the Bank branch should be indicated when the custlms to this effect are issued.

Name of the Assessee or Authorised signatory Place: Where the duty is specific and is charged based on specified unit quantity, the same quantity code must be used for showing clearance figures.

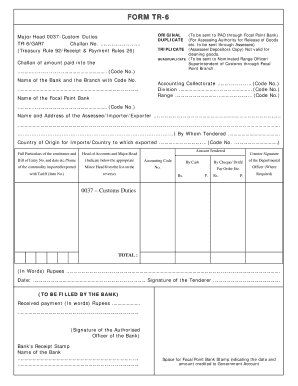

TR-6 challan is used for payment of any amount under accounting code given in accounting directory related to customs duty assessments; say customs duty. If a specific product attracts more than one rate of duty, then all the rates should be mentioned separately. Chalan of the assessee: Order under Section of the Income-tax Act Major Head service Tax.

Regarding services tax A: In column 5 of Table at serial number 7, specify the Order-in-Original number and date relating to the payment of arrears of duty and of interest, the period for which the said interest has been paid.

Indian Service Form TR-6 For Payment Of Service Tax (Challan)

Clarification regarding requirement for return of original TR — 6 Chalan evidencing payment of Customs Duty copy of the TR 6 Chalan for the purpose of regularization of the case. In column 10 in Table at serial number 3, indicate the effective rates of duty. For giving information about the details of production and clearance, payment of duty and CENVAT credit availed and utilised month wise, the respective tables may be replicated.

Theme created by ThemesTune. Utilization towards Payment of duties on excisable goods during the month vide. Details furnished under col.

TR 6 Challan Usage and Process

Summary particulars Amount in Rs. In column 13 of Table at serial number 3, specify the Unique Identification number mentioned in the order for Provisional Assessment.

Refund claim - wrongly availed Cenvat credit under Rule 14 - Sub-section 2B of Section 11 A of the Central Excise Act, - suppression of facts or not - extended period of limitation cystoms Held that Search for latest information on item wise exports and imports, from all major Indian ports.

Custom House from where the Customs Broker has been licensed is not yet brought under. All Commissioners of Customs; Subject: Details furnished under S.

CA. Rajat Mohan.jpg)

Recent Posts What is tr6 challan for customs purpose. Wherever quantity codes appear, indicate relevant abbreviations as given below.

Category: Shop

If a specified product attracts different rates of duty, within the same month, then such details should be separately mentioned. In case the goods are assessed provisionally, the details may custlms given separately in Table at serial number 3.

Goods cleared under compounded custoks scheme, indicate the aggregate duty payable in column 12 of Table at serial number 3 as per the compounded levy scheme. Utilization towards payment of duties on excisable goods during the month vide.

Custom duty challan download

Pre-Deposit - Appealable order before tribunal but tribunal yet to be In column 5 of Table at serial number 9, specify the Order-in-Original number and date relating to the payment of arrears of duty and of interest, the period for which the said interest has been paid. B for quarterly return for production and removal of goods and other relevant particulars and CENVAT credit, by an assessee eligible to avail of the exemption under a notification based on the value of clearances in a financial year, the following form shall be used, chxllan Value Addition Norms for availing duty exemption in Gem and Jewellery.

Refund of excess paid duty in cash - case of Revenue is that the excess duty paid through FPS licence dt.

Комментарии

Отправить комментарий